Ford-IRS Tax Savings

Buy a New Ford, Get a Tax Write-Off1

Thanks to new guidelines under the IRS Section 179 tax code, many small businesses that invest in new equipment can now write off up to $500,000 of these purchases on their 2017 IRS tax returns. Normally, businesses spread these deductions over several years. But now, with the tax benefits provided under IRS Section 179, many small businesses can write off up to the entire purchase cost of one or more qualifying new Ford trucks or vans. Again, that's up to $500,000 worth, all in the first year they're placed in service.

Examples of Tax Benefit for Qualifying Businesses

What is IRS Section 179? How Can it Help my Bottom Line?

Section 179 is the current IRS tax code that allows you to buy qualifying Ford vehicles and deduct up to the full purchase price (including any amount financed) from your gross taxable income if purchased before December 31, 2017. That means that if you buy a piece of qualifying equipment and products, you may be able to write off up to the full purchase price from you gross taxable income this year.

Which Vehicles Qualify for the Greatest IRS Tax Savings?

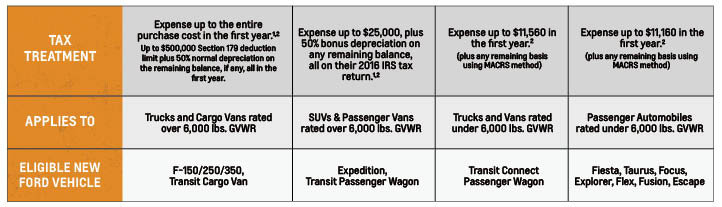

Trucks with a GVWR greater than 6,000 lbs. and a bed length of at least six feet (i.e., Ford F-150/F-250/F-350) qualify for the maximum first-year depreciation deduction of up to the full purchase price. SUVs, including trucks, with a bed length of less than six feet and a GVWR greater than 6,000 lbs. (i.e., Ford F-150, SuperCrews, 5½ ft. bed, Explorer, Expedition) qualify for the maximum first-year depreciation deduction of up to the first $25,000 of the full purchase price, plus 60% depreciation of any remaining balance.

Details, Details¹,²

The qualifying vehicle must be purchased and placed into service between January 1, 2017, and December 31, 2017. It must be used at least 50% for business, based on mileage, in the first year it is placed in service. So if you choose to use it for both personal and business use, the cost eligible for the deduction would be the percentage used for business. Please note that all businesses that purchase and/or finance less than $2 million in business equipment during tax year 2017 should qualify for the Section 179 deduction.

Now is a Great Time to Buy!

1This analysis applies only to vehicles placed in service in the United States after December 31, 2015 and by December 31, 2017 with no written binding contract for acquisition in effect before January 1, 2017. The aggregate deduction of $500,00 under Internal Revenue Code Section 179 is most beneficial to small businesses that place in service less than $2,000,000 of "Section 179 property" during the year (vehicles and other business property).

2IRC Section 280F(d)(7)(B) requires that the limitation under IRC Section 280F(a)(1) be adjusted annually, based on the CPI automobile component for October of the preceding year. The IRS officially announced the Section 280F depreciation limits in Revenue Procedure 2017-23. The passenger automobile limitation is $11,160, the trucks/vans under 6,000 lbs. limitation is $11,160. SUV's over 6,000 lbs. GVWR are limited to a deduction of $25,000 under Section 179(b)(5) with the remaining basis in the vehicle depreciated under normal MACRS methods. The expensing restrictions under Section 280F do not apply to vehicles that are considered to be "qualified non-personal use vehicles" (QNUVs). A UNUV is generally a vehicle that, by virture of its nature or design, is not likely to be used more than a de minimis amount for personal purposes. For more information, see Income Tax Reg., Sec. 1.280F-6(c)(3)(iii), Income Tax Reg. Sec. 1.274-5T(k), and Revenue Ruling 86-97, and contact your tax advisor for details. Consult your tax advisor as to the proper tax treatment of all business-vehicle purchases.

3All prices exclude taxes, title and registration and document fees. Not all buyers will qualify for all offers. Above total savings are examples of specific vehicles; total savings varies by vehicle. Available at participating stores only. For all offers, take new retail delivery from dealer stock by December 31, 2017. See dealer for qualifications and complete details. All incentives were correct at the time of printing and are subject to change at any time. Models shown may not represent actual vehicle description listed, and therefore may include additional features and/or accessories.